In terms of transitions, settling into college is a major one that can be super-stressful. Not only that, on-campus life can be an environment conducive to picking up bad habits and losing sight of priorities. Getting into college and paying for college is difficult enough; now that you’re there, set yourself up to not only survive but thrive.

Author: CampusBooks

The Real Deal About Textbooks

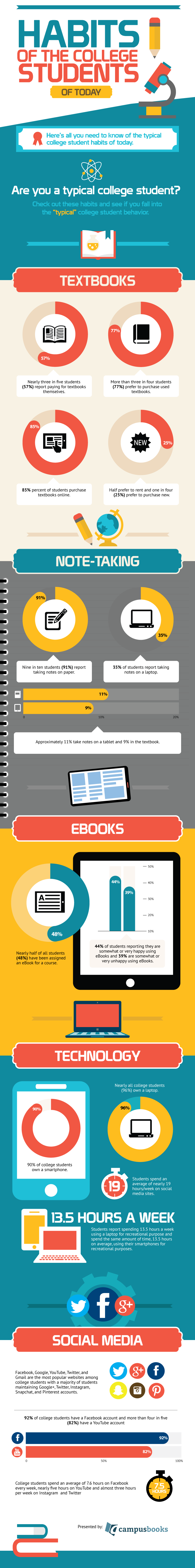

Tech and Text Habits of Today’s College Students

More than ever before, college students have greater options and opportunities for taking in (and sharing as well as creating) information and entertainment. Textbooks, note-taking, class collaboration, research, social interactions . . . it’s all available from multiple mediums and vehicles and nearly anywhere at any time. With the rise of distance-learning and with changes to textbook formats (rentals, eBooks, and customized packages) and greater interactivity in the form of cheaper more-powerful more-portable computing all happening right now, we wanted to examine the relationships between college students and technology (full info about our larger survey here). Here’s what we found.

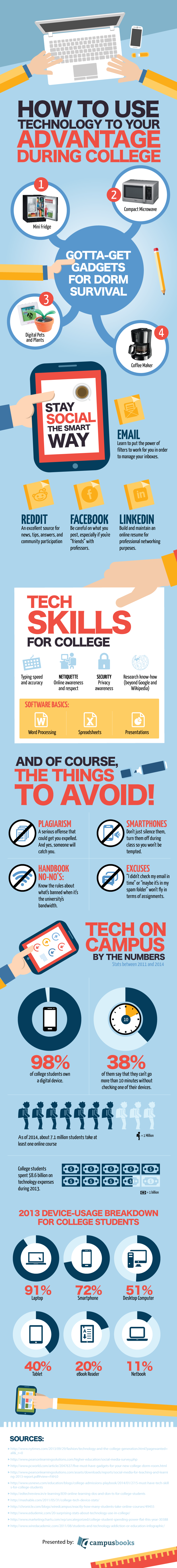

Putting Technology to Work for You at College

Technology can be a huge help in college. It can help you communicate, find information, share resources, add comfort to your dorm room, remind you of deadlines, and so much more. It can also be a huge time-suck, distraction, and temptation. There’s no doubt that you need solid technology on campus (for work and for fun) and that college students tend to be some of the most-gadgetized early adopters of new tech. Use this handy infographic to make sure you’re using technology to your advantage rather than your detriment.

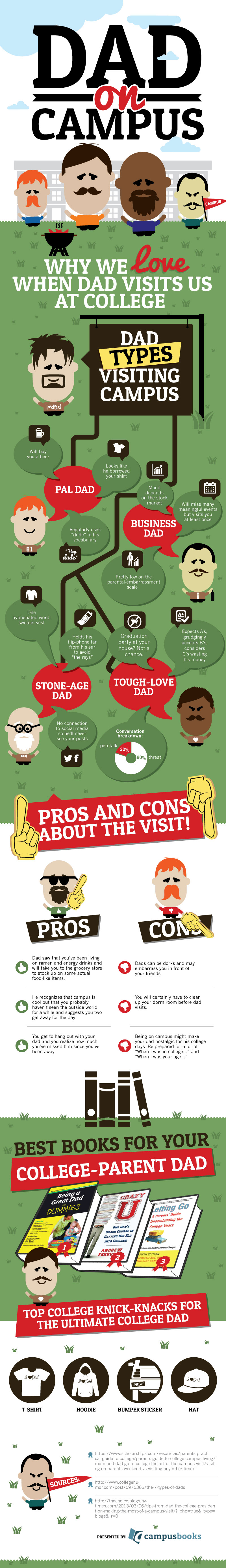

Just in Time for Father’s Day, It’s Your Guide to Dad on Campus!

With Father’s Day on Sunday and summer school in effect, we’ve got Pops on the brain — particularly the hilarious, heartwarming, relationship-building, potentially embarrassing campus visits from dad. Whether your papa is far away and a “drop off freshman year, pick up at graduation” kind of dad or a dad who is nearby and wants to visit you every weekend (thanks, but no thanks, daddy-o), your college years are key to forming your new adult relationship with your father. And remember, even if he doesn’t visit often or he can’t say it, your dad is proud of you!

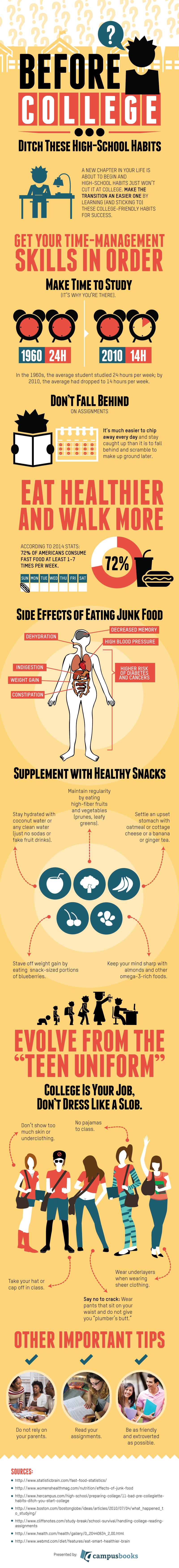

Headed to College? Ditch These High-School Habits.

Congratulations on wrapping up your senior year of high-school! Well done. Heading off to college is still a few months away so why not use that time to prepare for the experience by ditching the high-school mentality, opening your mind for the changes ahead, and getting into some good habits now so you can start freshman year off right?

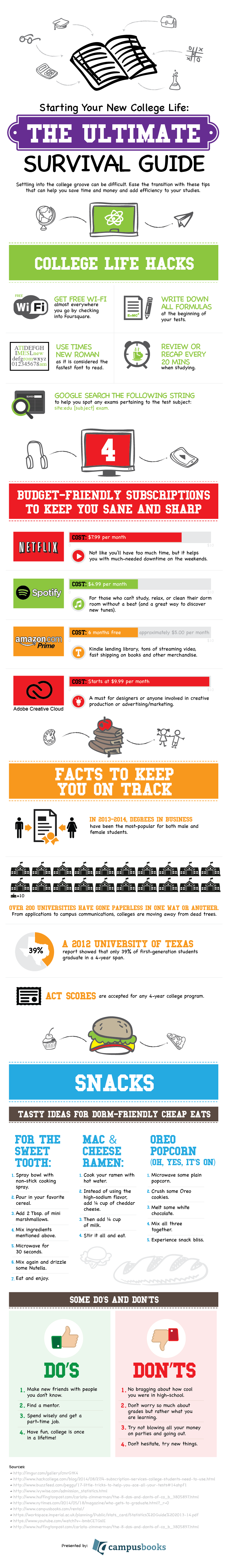

Top Tricks for College

Part of getting a college education is about learning the things that aren’t in books or in lectures. In fact, much learning is done in terms of self-maturation and navigating things like time-management, friendships and relationships, health and wellness, and finances. College is about academics but it’s also about finding your groove, employing best practices, balancing work and fun, realizing your strengths and weaknesses, and developing efficiencies to help you succeed without compromising quality or ethics. It’s all important and part of the larger experience. With this school year wrapping up, summer sessions nearing, and some time to reflect before fall semester, read what other students have found helpful and give some thought to incorporating these tricks into your own college routine.

Top-5 Ways to Save Money This Summer

Summer is coming. What are your plans for the next few months until you head back to school? While you certainly want to relax and forget about the stresses of college studies, you may also want to devote some time to financial management and saving money. Tuition isn’t cheap and the money decisions you make during your undergraduate years can shape your post-college financial future (just ask anyone with student loans or someone who was convinced that a free t-shirt was a good reason to take on a high-interest credit card). Take a few minutes and check out our tips for saving and generating some cash this summer.

- Invest in a Short-Term CD: If you have any sort of a nest egg that you won’t need over the summer months, consider investing it in a short-term CD. The interest rate you receive won’t make you rich but it will be more than what you’d get leaving your money in a checking account account and you won’t be tempted to withdraw it for debit-card purchases. Starter CDs require just a small amount of money for a small amount of time so if you have a few hundred dollars or more and you won’t need it for six months or so, bank it in a CD for more interest. Remember that the more you invest at first and for the longer the duration, the more interest you’ll earn, but the penalties for early withdrawal can be substantial so don’t over-commit. Check rates online at NerdWallet or Bankrate.

- Relax in General and Relax on Entertainment Expenses: College can be stressful so it’s expected that you unwind and let off steam. But given that this is college we’re talking about, nothing is done on a small scale. Big exams and big papers tend to mean big parties immediately following. Take time this summer to enjoy things being a little less intense all around. Without the stress of hardcore studies and exams and deadlines, you can chill on smaller, cheaper scale. Instead of hosting that costly mega-bash or bar-hopping, get together with friends and family for things like game night, day hiking, walking dogs, catching up while doing some deck sitting, and movie marathons when summer storms hit.

- Work: Take a part-time summer job or an internship. In addition to earning some money, you’ll meet new people, make valuable connections, gain experience, figure out what you like doing and are good at, and come to appreciate your free time a lot more. If you’re serious about your direction already, get the scoop on summer internships (it’s not too late!) If you’re still finding yourself, enjoy working without the pressure of making it into a career and be open to doing stuff like waiting tables (you’ll make amazing friends and eat cheap) or do landscaping (you’ll get a tan and be ripped). If you’re on the less-active side of things, turn Web time into paid time and do surveys for a company like Pinecone Research.

- Pay Off Credit Card Debt: Every dollar you pay down on your balances is one less dollar you have to pay interest charges on moving forward. Take a look at your balances and use any money you earn over the summer to bring down your debts. Credit-card debt is a killer whether you’re in school or not, and the sooner you get it paid off, the more money you can save. Remember that you don’t have to pay it all at once, just chip away at it by every month paying off more than you spend.

- Take Advantage of the Time at Home: If you’re currently living off-campus, do not make the mistake of remaining in that housing over summer break if you’re paying monthly rent. Move out or sublet the place and go home for the summer where the cost of living is much less. Even though living back under your parents’ roof can be a pain, you can save big time on expenses. If mom and dad are the generous type, you’re likely to enjoy free food and laundry services while you save on several months’ rent. Just be cool about it and show your appreciation. Help out around the house, hug your folks, and give thanks for how good it is to come home and find support and love.

If you hadn’t already noticed, the cost of college is astounding. Even if you’ve never been a planner, it’s important to understand that the average college student now graduates with a stunning $27,000 in student loan debt. Kick back all you want over the summer, just keep costs in mind. For every dollar you don’t spend this summer, that’s one more dollar you can put toward your loan balances.

Guest post courtesy of MoneyCrashers.com‘s Josh Hall, a personal-finance writer who discusses college costs, money management, and smart budgeting tips.

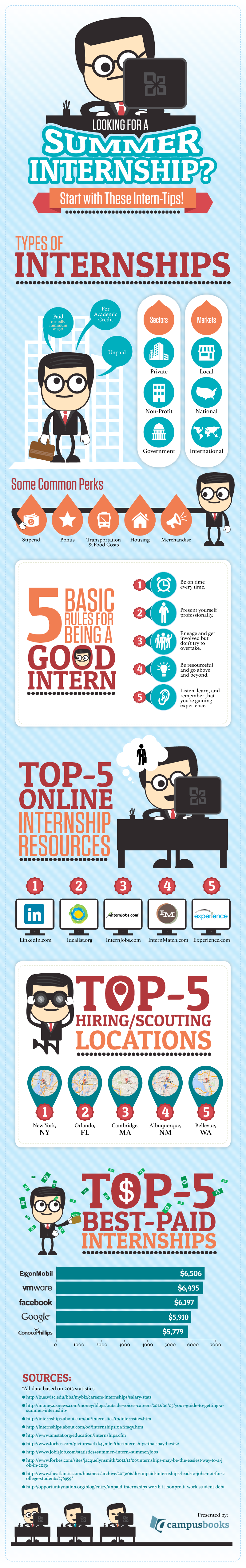

Summer Internships

Got a summer internship already lined up? Still looking for one? Considering whether an internship is right for you? We can help. Here’s the scoop on types of summer internships, how to be a good intern, and what to expect in terms of compensation and experience and subsequent job leads after internship.

Get Your Spring Break On!

March is just around the corner and with it comes the countdown to the best college vacay known to humankind: Spring Break! Whatever you’re up to, travel or volunteering or catching up on much-needed sleep or chilling with your family back home or parties by day and night, get your must-do’s organized so you maximize your break time and return to college rejuvenated.