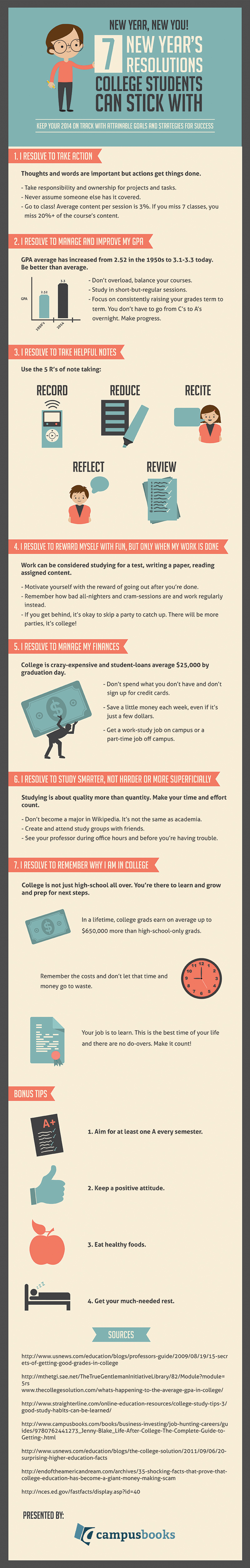

The new year brings with it inspiration for improvement for all of us but also a particular set of resolutions and goals for college students. Those do’s and don’ts you set around January 1? Those ambitions and strategies for change for the better? They’re important but they tend to go by the wayside a week or two in as winter break ends, the new semester kicks off, and old habits return. That said, we’re checking in with you a couple of weeks into the new year with our down-to-earth realistic resolutions and reminders that any college student can stick with for 2014 and years to come. Make this your best year ever!

Category: Uncategorized

The Pros and Cons of Dog-Ownership While Attending College

For many, having a dog waiting for you when you got home from school was a way of life growing up. In fact, The Humane Society estimates there are currently 164 million pets in American homes. As many students move away to attend college, they may consider owning a dog of their own — but what are the pros and cons of owning bringing a canine friend while pursuing further education?

Pro: Overall Health

Pro: Overall Health

Owning a dog can contribute to your overall well-being in a variety of unexpected ways. Pets are excellent stress reducers, and spending time petting your dog can reduce your blood pressure and release relaxation hormones to help you to function more efficiently, according to WebMD. Other positive health benefits often attributed to dog ownership include lower blood pressure, faster recovery from illness and injury, and lower cholesterol levels.

Con: Cleaning

Dogs can be lovable, albeit messy. Dogs, especially puppies, come with the additional responsibility of cleaning up after them. If you adopt a puppy, you will have to housebreak the pup, which can take a lot of time and patience. Additionally, dogs need to be bathed, brushed, and have their nails clipped regularly.

Pro: Physical Fitness

Dogs need exercise and aren’t shy about it. Dog owners are more likely to go walk or run with them and having a dog almost forces you to exercise regularly. While you might be content to sit on the couch instead of exercise, a dog who doesn’t get regular walks will become restless and possibly destructive around the house. There’s no better motivator to get out and run than the possibility of a ruined couch.

Con: Expenses

If there’s one thing you’re short on while attending college, it’s money. Owning a dog can be a big financial commitment. Flag Pets reports the average cost of pet ownership comes to about $360 a year just for food — vaccinations and annual medical treatment can exceed $200. That doesn’t include toys, dog doors, treats, or other supplies. Additionally, if something happens to your pet, such as injury or illness, veterinarian bills can be extremely costly if you’re unprepared for them. Expect a dog to cost in total about $1,000 annually.

Pro: Love and Laughs

Nothing compares to the unconditional love a canine companion provides. They’re always happy to see you and always supportive regardless of how bad a mood you might be in. For students living away from home for the first time, a dog can provide much of the companionship and sense of family that might be missing from their new life. The love and friendship forged between humans and canines is the stuff of novels and films and can last for years to come. Dogs are family.

Con: Planning

If you’re the type who enjoys the freedom of going out all night or taking spontaneous road trips, owning a dog might not be feasible. Dogs need to be cared for and arrangements need to be made if you intend to not be home. Dogs can’t be left alone if you decide to stay out all weekend, and caring for a dog doesn’t allow for much error. When trying to figure out whether owning a dog is right for you, keep in mind what your current schedule is like and seriously consider if you have the time and finances to care for a new member of your household.

Making the Right Choice

Whatever you decide to do, think carefully and don’t act impulsively. A pet is a commitment for the animal’s life and not one of convenience. There’s no rush and you’ll have plenty of time soon enough to have a canine companion if now isn’t the right time. And when that time does come, do a solid by your future pup as well as all animals in need and adopt from a shelter or rescue group. Your new bestie will thank you with love and devotion every day for it.

Find even more useful tips on the dog ownership at MyPetNeedsThat

The Pros and Cons of Off-Campus Living

How awesome would it be to have an apartment of your own? It would give you your own space and freedom. It would also give you more bills and a landlord. Off-campus living has many great advantages and plenty of disadvantages to consider before making a move into your own apartment.

Pro: Freedom

Pro: Freedom

Let’s start with the obvious. There is no RA looking over your shoulder. You do not need to share a bathroom with a dozen other people. You have autonomy to do what you want to do. If you have the ability to swing an apartment of your own, then you do not need to deal with a roommate. You can be as messy or as clean as you like with no one to criticize you, except maybe a parent on periodic visits. Your own apartment also allows you to bring home dates as you wish. These are all important parts of your development into an adult.

Con: Missing Out

There is a reason the Princeton Review puts out a list of the top party schools. Campus living can be fun and, if you are not there, you can miss out on a lot. This year, the University of Iowa topped the list of party schools. It also came in first on the “Lots Of Hard Liquor” list and forth on the “Lot Of Beer” list. These things are not going to come to you if you are in your apartment. Other fun and academic activities are easier to access when living on campus.

Pro: Working Through The Summer

The hope is that you have a job that allows you to work around your class schedule and has no problem with you leaving for two or three months in the summer. The reality is that that is probably not the case. Most jobs that are okay with you leaving in the summer are intern positions or low paying. Having your own apartment will allow you to keep the job. Of course there is a catch 22 situation to this. You need the apartment to keep the job and you need the good job to keep the apartment.

Con: No Credit

Apartments can be expensive. Look at Boston apartments as an example. According to RentalBeast.com, an average Boston apartment can run about $1,881 per month. They are not just going to give you this apartment because of your good looks. You will need first and last month’s rent, a security deposit, and a credit history. If you have no credit history, you may need to come up with an additional deposit or be able to show that you have a strong income. If none of that works, then mom and dad may need to cosign for you.

Pro: Building Credit

You may have no credit now, but establishing a payment history can help create a good credit account. Experian and TransUnion report rental payments as positive credit. If this is important to you then ask your landlord to report lease payments to the credit bureaus. Also, utilities and telephone bills that are paid on time will all show as positive reports towards your credit rating.

Con: Financial Aid Won’t Cover It

If you have a good job that covers rent, then an off-campus apartment may work for you. If you are working from a smaller salary and financial aid, talk to you student financial adviser. Financial aid and student loans generally do not cover living expenses that are not on campus.

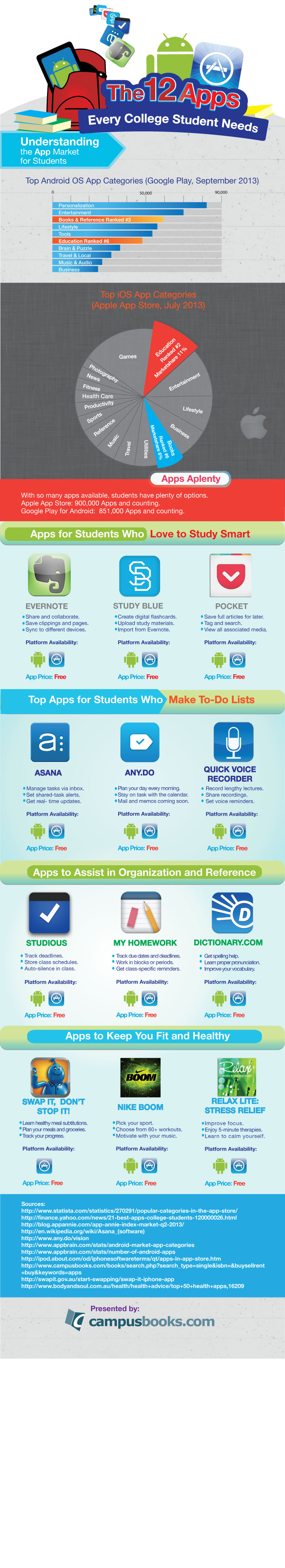

12 Apps Every College Student Needs

Your smartphone isn’t just for posting selfies, Tweeting clever observations, and finding the best happy-hour deals in your town, it’s actually a powerful platform for helping you make the most of your college experience, academic and otherwise. We’ve rounded up a dozen apps beneficial for all college students, regardless of your device’s OS and your personal learning style. Oh, and if you need one more to make perfect baker’s dozen, we’ve got our own CampusBooks.com scanner-enabled app that can help you save on college textbooks and get more cash at buyback.

The Curious Case of Shoulder Surfing: How Libraries Pose Security Risks

Whenever you’re in college and want to go where the fun is, you can always head to…the library? Seems like an odd choice, but eMarketer reports that today’s generation of college students are spending more time in front of digital screens than they are back in their rooms watching TV. The library is no longer a place to cram or to pick up books for a last-minute essay: It’s a place where students connect with one another, whether they’re a room away or a state away. This connection is not without risk, however. What threats lurk in libraries?

Mobile Theft

Leave a cell phone on the table while you go to the bathroom, or your laptop on while you head to the printer. Come back, and it’s gone. If this sounds like a familiar story, you have company. Theft is by far the most common crime reported on a college campus. The theft often involves a laptop or mobile phone snatched up when the owner took their eyes off of it for a split second. Pulling an all-nighter at the library may make you less thoughtful of the risks of taking a smoke break or thinking that you are alone in the study section may make you take risks. Whatever the case, you can easily prevent theft simply by having your mobile on your person at all times. Lock it down whenever you do not use it.

Shoulder Surfing

When a person walks by you half a dozen times, they may just admire your shoes or your watch…or they may try to sneak a glance at the digits on display on your screen. “Shoulder surfing” is a real risk to college students at the library or in the dorms, since our passwords, student numbers and even credit card information may show up on display at any given time to anyone who walks past. Be aware of shoulder surfing by accessing password-specific sites before you go to the library and never putting personal information on a page unless you’re in the safety of your apartment or dorm. Get protection against shoulder surfers with an identity theft protection service, so that those who do try to shoulder-snipe your data come away empty handed once they hit the protective wall.

Class Papers

With several hundred students under their charge, a professor likely asks you to include name, student ID and possibly a contact number. If you throw away old papers at the library, you never know who is coming to pick up the trash and glean this treasure trove of personal information. College students are at some of the greatest risks for identity theft, says the Better Business Bureau, partly because they do not realize the importance of shredding or destroying sensitive information. A fellow student, library worker, janitor or random person off the street can take a thrown-out paper and use the information in conjunction with student records or social media pages to steal your identity.

So You Want to Save on Textbooks?

If you’re a student, you know that every penny counts. That said, we’ve put together this new video showing you what’s up with CampusBooks.com and how it’s a must-use savings site for high-school students, undergrads, graduate students, avid readers, and anyone who loves a good deal.

Whether you’re buying books, renting books, or selling books back, we’ve got you covered. See how much you can save using CampusBooks.com, how easy it is, and how you simply can’t afford not to compare prices on textbooks. We’re on your side and helping you save more than just pennies.

Study Habits: The Best and the Worst for All Types of Learners

All methods for studying are not created equal. In addition to some being more efficient than others, study methods are highly personal and what works for one college student may not work for another. Fear not, we can help you find your study groove. Just in time for the new semester (and knowing that your time is valuable and limited), we’ve come up with this infographic to help you understand your individual learning style and maximize your academic efforts. Remember: it’s not about studying more or harder, it’s about studying smarter. Got any more tips, tricks, best practices, pitfalls to avoid when it comes to studying? Leave us a comment and help your fellow students.

Please use the HTML code below to embed this graphic

Created by <a href=”http://www.campusbooks.com”>Campus Books</a>.

Please use the above code unaltered or include a citation of this site as the original source.

Dear High School Grad: Here’s What to Expect From College

Instead of spending full days in high school classrooms, college students spend significantly less time in the classroom, but more time studying. College students experience more independence, which means more academic responsibility and accountability.

College Classes

As a college student, you’ll choose the courses you take with the help of an academic adviser. Classes may or may not meet every day, and attendance policies will vary widely from school to school and professor to professor. You’re responsible for arriving on time, completing assigned readings, and turning in homework when it’s due. Your job is to pay attention during lectures and note important points to remember for passing the exam or writing a term paper.

Students are also required to buy their own textbooks, which can be costly. Research any e-textbooks to save money, and download the NOOK Study app as a study tool for organization, reading, highlighting, note taking, and researching.

Study Methodology

For every hour you spend in class per week (or for each semester hour of your total course load), you should be prepared to study for at least 2 to 3 hours per week. If you’re taking a full course load of 15 semester hours, studying at least 30 to 45 hours a week is a good objective.

Check the syllabus lists for specific reading material on a given day. The expectation is that you will have read it before coming to class, which means devise your own system for keeping track of assignments.

If you use your laptop, tablet or Netbook during class, Evernote can help you take notes and organize information. As another study buddy, check out Simplenote for effective note taking, list making and sharing capabilities for study groups. It uses Pinterest-like pins and Facebook-like tags.

Tests & Grading

As you walk into a lecture hall, expect occasional quizzes that may or may not be announced. Tests are comprehensive and have significance impact on your final course grade. Professors may conduct review sessions outside of class hours and provide study guides. Exams won’t follow the same formats, which may be a combination of multiple choice, short answer and essay. If you miss a test, it’s your responsibility to contact the professor and discuss how and if you can make it up.

Online Learning

Online education is a practical and affordable academic alternative for students who work full-time or need flexibility. On-campus college students can even enroll in a single online class if the desired course doesn’t fit into their schedule or if it’s full. Full-time students enrolled in an online institution can still earn a credible certification or degree. For example, Penn Foster offers certificate, associates and bachelors degree programs as well as online student communities and active social networking pages that support student interaction within the virtual universe.

Google Drive also provides online students with spreadsheet and word processing capabilities that can be shared among multiple users. Students who want to share notes, ideas, or other information with their fellow students, or with professors, can do so easily with Google’s free apps.

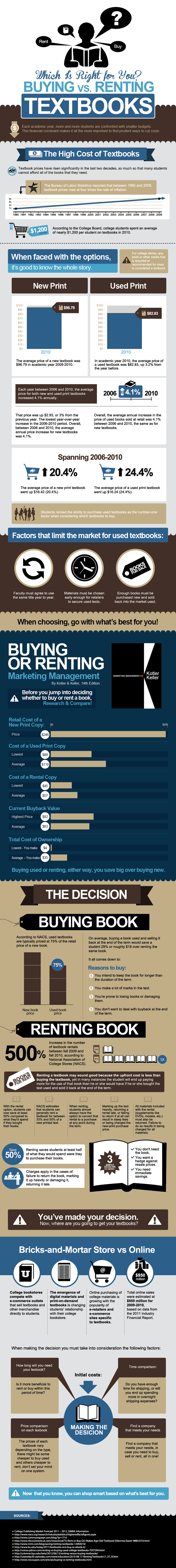

Renting vs. Buying Textbooks

How Can I Tell Whether It’s Better to Buy Textbooks or to Rent Them?

We know that it can be a little confusing to discern which is the better deal — buying or renting textbooks. And the truth is that it’s a little confusing because there is no right answer for every student or even for every book; sometimes buying textbooks is best, sometimes renting books is the better option.

So how do you know? Well, just in the nick of time for back-to-school, we’ve got a brand-new infographic sure to help you be the smartest shopper you can be when it comes to textbooks. Save on, students, save on.

Please use the HTML code below to embed this graphic

Created by <a href=”http://www.campusbooks.com”>Campus Books</a>.

Please use the above code unaltered or include a citation of this site as the original source.

Student Loans Double, But It’s Bigger Than That

On June 28, we shared (via Facebook) an Inside Higher Ed article about the political deadlock that made it so that the interest rate on student loans would double from 3.4% to 6.8% on July 1. At that time, it seemed clear that members of Congress were unwilling to cooperate to get the job done and keep the rate from doubling. And that is indeed what happened when Congress failed to act before the deadline

Knowing that the rate hike was a heavy burden on students and families (but likely more concerned about alienating young voters), members of Congress went back to the drawing board in an effort to reach some sort of agreement that would soften the blow of the rate hike. Squabbling Republicans and Democrats were close to a compromise, but that derailed when it was calculated that the estimated cost of the plan over 10 years was $22 billion.

Right now, the rate hike that occurred on July 1 stands. Interest rates are a fixed 6.8% on student loans and that is indeed up from 3.4%. Congress, which seems to have little trouble bailing out banks and mega-corporations, is once again unable to reach agreement in solving the problem and there is no indication as to when or even if that will be resolved.

This stalemate clearly sends a message to students and families that the affordability of higher education is not a priority for politicians and that they are more concerned with short-term savings than with education and enrichment. It’s certainly easy to get angry about this (and rightly so), but Patricia Murphy makes an important point that there is a much-bigger problem encompassing affordability in her article “The Real College Crisis Isn’t About Student Loan Rates.”