Feeling a little down? Sometimes a health issue is as simple as a mild cold, allowing you to get by with using over-the-counter medicines and extra rest. At other times, though, you may need to see a medical professional. When is it time to make an appointment at your campus health center?

When You’re Ill

The pressures from your classes and your job can make you feel as if you don’t have the right to take a break from your routine so that you can care for your health. However, if a cold or influenza becomes serious enough, it can lead to other, more worrisome problems. You also don’t want to go to class if you’re contagious and then become the reason why half the people in your class get sick.

If you experience any of the following symptoms, it’s time to make an appointment at the campus clinic:

- Inability to keep food down

- Painful swallowing

- Cold and flu symptoms that last longer than a week

- Earache

- Coughing that lasts longer than a couple weeks

When You’re Injured

Sports are a great way to blow off steam on the weekends, but what if you take a fall and find yourself limping afterward? You might be tempted to avoid the clinic and tough it out, but doing so can exacerbate an injury. The following are some signs that you should get a professional opinion on your injury:

- The pain becomes progressively worse.

- Your joints are swollen.

- You have pain even when you are resting at night.

- You have bruises that do not heal.

- Your knees, elbows, or other joints lock up or are otherwise unstable.

Ask whether anyone who works at the campus health center is an expert in sports medicine. Sometimes regular physicians do not have the training necessary to address sports injuries in the best way.

When You’re Stressed or Depressed

Your mental health is just as important as, if not more important than, your physical health. Why, then, do so many college students ignore obvious signs of depression or severe stress? According to one survey, only about 10 percent of students take advantage of campus mental health services even though these services are often free or low-cost.

If any of the following is true of you, you may benefit from a trip to your campus counselor:

- You don’t feel like yourself. You’re inexplicably sad or angry.

- You’re abusing substances to cope with trauma or stress. You may be overindulging in food, alcohol, sex, or drugs.

- You’ve experienced a loss. Everyone deals with grief in different ways, and counseling may be what you need to weather the death of a loved one.

- You’ve lost interest in things you normally enjoy.

Too many college students avoid taking advantage of therapy because they feel ashamed. However, there is no shame in getting needed help. The sooner you can get your life back on track, the better.

Mahatma Gandhi once said, “It is health that is real wealth and not pieces of gold and silver.” Indeed, your health is one of your most valuable possessions. Take care of it by heading to the campus health center when you experience a serious illness, injury, or mental health issue.

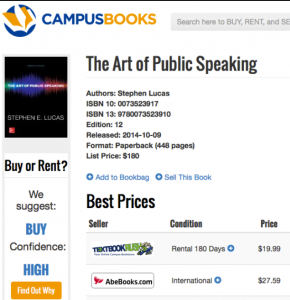

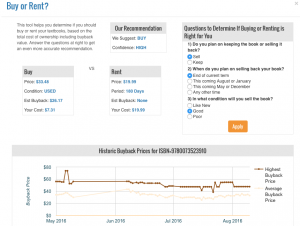

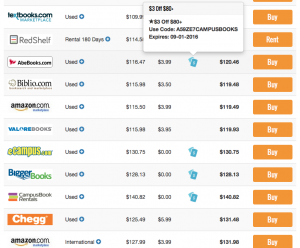

It’s so easy and so helpful and it takes the guesswork out of getting textbooks without getting ripped off. Just do what you already do: go to

It’s so easy and so helpful and it takes the guesswork out of getting textbooks without getting ripped off. Just do what you already do: go to

See it? Sweet. Now mouse over that icon (or see the details below the listing if you’re using

See it? Sweet. Now mouse over that icon (or see the details below the listing if you’re using